Credit: Ketut Subiyanto via Pexels

For the first time in years, the Ontario real estate market has experienced something of a cooldown lately. Prices are considerably higher than in 2020 but, in some cases, less than in 2021.

First-time homebuyers in Ontario (those who have never owned a home anywhere in the world, in full or in part) face obstacles, but buying a home is possible. Indeed, in 2021, a year where home prices increased by 30%, first-time homebuyers accounted for 20% of all sales.

Here are some tips to help first-time homebuyers put a roof over their heads:

First-Time Homebuyers Refund

The Ontario government lets first-time homebuyers get a refund on all or a large chunk of the land transfer tax. To be eligible, you must be at least 19 years old, and neither you nor your spouse can own a house.

However, it’s OK if you acquired a home through inheritance or as a gift. When you’re saving up for a down payment, factor in your exemption to the tax, and you’ll be closer to seeing the light at the end of the tunnel.

Nobul

If you are a first-time homebuyer, Nobul will make all the difference for your home-buying experience. Nobul is a real estate tech platform designed by digital innovator Regan McGee that tilts the playing field in the buyer’s favour. Instead of needing to have a relative or family friend in the real estate industry to get you a deal, anybody can use the platform and have agents competing for their business.

As Regan told Toronto Life magazine, “people think buying and selling real estate is complicated, but that’s a way for agents to justify their fees.” Compare the agents’ profiles on the app, which transparently display their services, fees, experience in closing sales, and verified user reviews.

The data is reliable because the platform doesn’t accept money from agents to get listed. With the help of an incentivized real estate agent and the platform’s powerful algorithm relaying listings that align with your specifications so perfectly that they seem curated, first-time homebuyers have a powerful tool.

Municipal and Federal Boost

First-time homebuyers should help themselves to all the support they can find from all levels of government, municipal, provincial and federal. In 2021, the Liberals increased the home eligibility threshold for the Canadian Mortgage Housing Corporation from $120,000 to $150,000.

In other words, you can get federal assistance on a more expensive home now, which is key as housing costs rise. While preparing your finances and getting all your ducks in a row, research what financial support you can get from your local government.

For example, homes in Toronto may be subject to a municipal and provincial land transfer tax. First-time homebuyers have a preferential path, but you’ll need to see where you fit into it based on your specific scenario.

Homebuyers are buying a lot more than a roof over their head. Investing in property is also an investment in your future, as your home will provide a nest egg down the road. Don’t be discouraged by market conditions. Keep the above in mind, and you’ll have a wonderful place to live and a sound investment to call your own.

More Stories

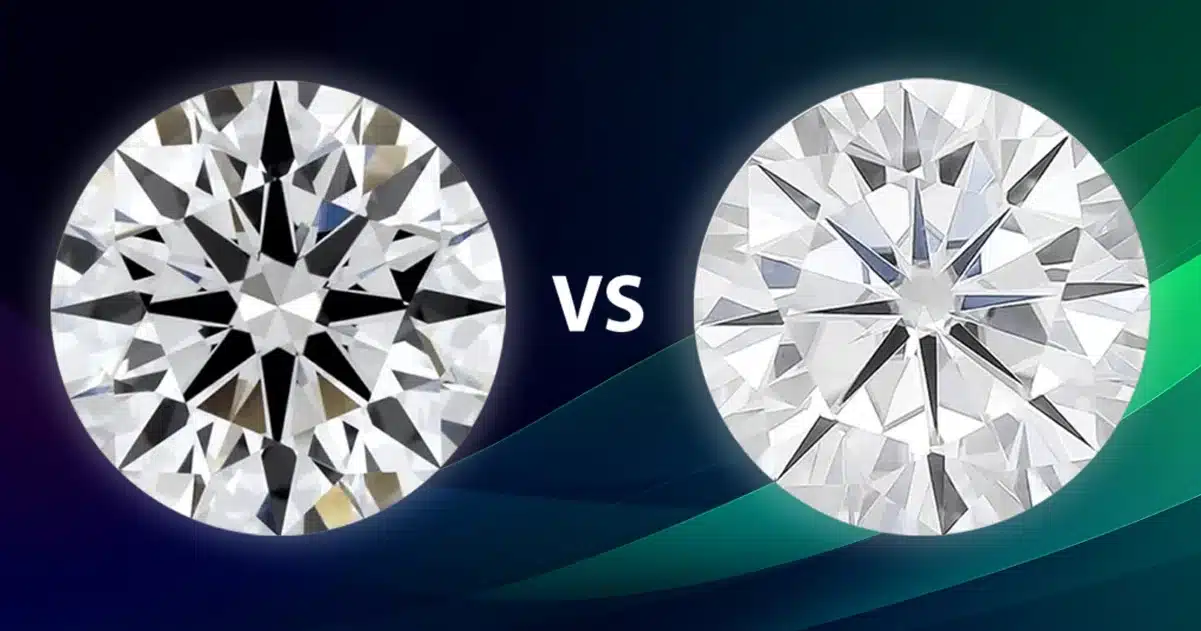

What Matters in the Diamonds 4Cs: Understanding Lab Diamonds

How to Attract and Retain Top Talent in the Construction Sector

The Babysitter Guide Expert Care, Every Time